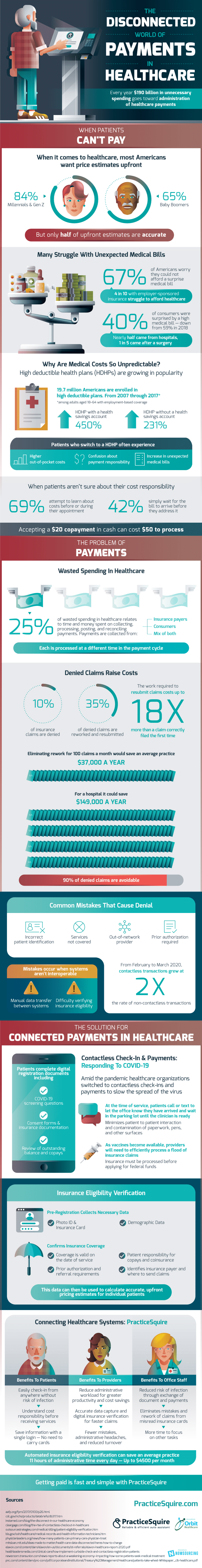

Every year, $190 billion in unnecessary spending goes toward the administration of healthcare payments. A large part of the problem is that patients don’t know how much they will be charged before or during appointments.

Only half of the upfront estimates are accurate. If the actual cost is higher than the estimate, 67% of Americans worry they would not be able to afford the surprise medical bill. This number includes people with employer-sponsored insurance.

As high deductible health plans (HDHPs) grow in popularity, so too does the unpredictable element of medical costs. As of 2017, 19.7 million Americans are enrolled in high-deductible plans. Patients who switch to an HDHP often experience higher out-of-pocket costs, confusion about payment responsibility, and an increase in unexpected medical bills.

On the side of the medical office, payment dysfunction is also a major issue. Accepting a $20 copayment in cash can cost $50 to process. 25% of the wasted spending in healthcare relates to time and money spent on collecting, processing, posting, and reconciling payments.

Payments are collected from insurance companies and consumers, with each processed at a different time in the payment cycle. As low as 100 denied and reworked claims resulting from easily fixed errors like incorrect patient ID and prior authorization required cost an average practice $37,000 a year.

The work required to resubmit claims costs 18x more than a claim filed correctly the first time. The cure to this expensive disease? Contactless check-in and payments, as provided by PracticeSquire. Pre-registration collects photo ID, insurance card, and demographic data.

It confirms insurance coverage and payment amounts before the patient receives care. Automated insurance eligibility verification can save an average practice 11 hours of administrative time every day.

That is up to $4500 a month! Getting paid is fast with PracticeSquire.