Navigating the world of health insurance is never easy. When it comes to vision and dental expenses, which aren’t always covered by health insurance, things can get quickly become expensive.

A specialized savings account can help you save money, and pay those extra expenses like your next pair of glasses.

HSA vs. FSA ─ what’s the Difference?

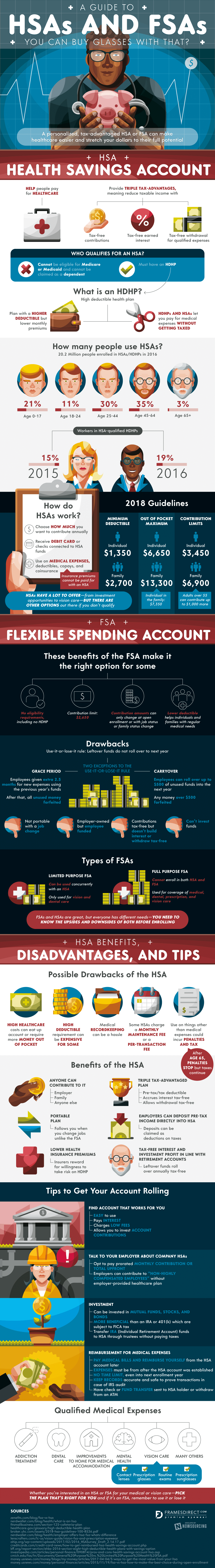

If you sign up for a high deductible healthcare plan you’ll be eligible for a health savings account, or HSA. This type of account lets you put money aside for health expenses from your pre-tax income, and you never have to pay taxes on withdrawals or earned interest.

Because these accounts are paired with a HDHP insurance plan, your monthly premiums will be lower, giving you savings you can invest in your HSA for future medical expenses.

Not everyone qualifies for an HSA, but a flexible spending account, or FSA is available to anyone. FSAs get the same tax breaks as HSA accounts do, but they don’t earn interest, and have an annual contribution limit.

Your monthly contribution can only be changed at open enrollment or when you change your health insurance. But unlike an HSA, funds saved in a FSA don’t stay with you.

Choosing the Best Plan

Both HSA and FSA have drawbacks that needs to be considered when selecting your insurance. When you put money into an HSA, the funds carryover year-to-year and can be take with you to another job, or into retirement.

An FSA limits the funds that carryover and anything over the limit expires at the end of the year, or when you change jobs. Some FSAs can be used for any health expenses, while others are limited to vision and dental care.

HSAs, on the other hand, require a high deductible insurance plan that could mean much higher medical costs, especially if you need frequent medical care or have a major accident.

Some HSAs have a monthly charge or per-transaction fee, so be careful to read the fine print before you sign up. And of course, these plans will charge you penalties if you spend funds on anything other than healthcare.

Getting Started

Once you talk to your employer about the options they offer (your company might even make contribution to your account), decide which option is best for you. If you generally have low monthly healthcare costs, opting for a high deductible plan with an HSA can save you money long-term.

If your monthly healthcare costs are higher, a lower deductible insurance plan and FSA may be the better option. Either way, it’s important to weight the various costs and benefits before selecting the plan that works best for you.

If you choose an HSA, your funds can be invested in mutual funds, stocks, or bonds for added benefit. You might also consider transferring money from your IRA to an HSA to save on taxes.

Whichever account you choose it’s essential to keep good record to prove your spending was only on qualified medical expenses. Learn more from this infographic.